Should We Drill in ANWR?

The Problem: World Oil Supply and The Hubbert Peak

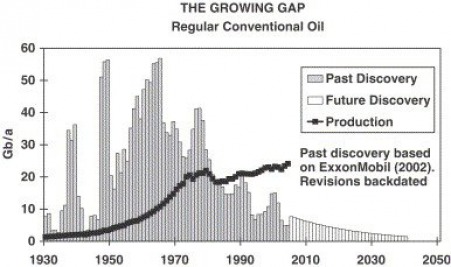

Fig. 1 The Growing Gap Between Production and Demand of Oil. (Campbell, 2006)

Oil is among the most important natural resources on earth. The well-being of the world's economy depends on it. Our way of life would not be possible without it. And as with any important natural resource, it isn't without it's problems. Through the use of oil our world has experienced unparalleled wealth and economic growth in the past 200 years. But today, our dependence on oil has left our economies vulnerable to it's supply and our environment unprotected from it's effects. These two seemingly insurmountable obstacles: dependence on oil and global warming have begat perhaps the most daunting issue mankind has ever had to tackle. And the question is no longer “Are we running out of oil?” because oil most certainly is a non-renewable resource with a finite supply, of which our demand far surpasses our discoveries of new reserves (Campbell 2006, 1319; and Longwell 2002); the question now is, “What are we going to do about it?”

For better or worse, since 1981, the world has been using more oil than it has discovered (see figure 1), and even oil companies are beginning to admit that oil discovery reached a peak somewhere around 1960, and has been in a state of overall decline ever since (Longwell 2002). This is a starling revelation because demand for energy is rising and, by even conservative predictions, will continue to do so exponentially in coming decades. These two opposing forces of dwindling supply and soaring demand are a recipe for turmoil. This is incredibly bad news as we look into to the future at the prospects of our environment, our economies, and our hope for peaceful international relations.

For better or worse, since 1981, the world has been using more oil than it has discovered (see figure 1), and even oil companies are beginning to admit that oil discovery reached a peak somewhere around 1960, and has been in a state of overall decline ever since (Longwell 2002). This is a starling revelation because demand for energy is rising and, by even conservative predictions, will continue to do so exponentially in coming decades. These two opposing forces of dwindling supply and soaring demand are a recipe for turmoil. This is incredibly bad news as we look into to the future at the prospects of our environment, our economies, and our hope for peaceful international relations.

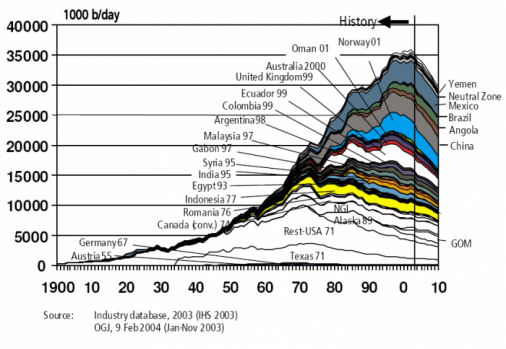

Fig. 2 The Hubbert Peak

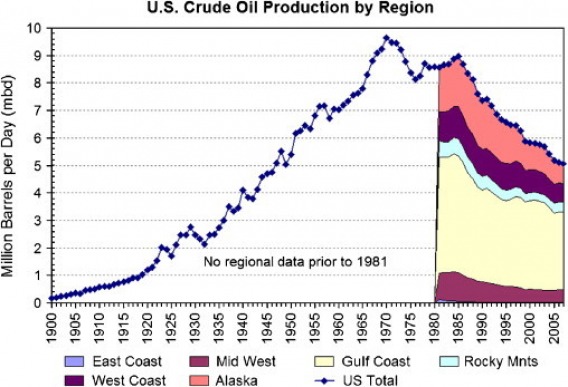

Another implication of oil discovery reaching it's peak some time ago, is that the Earth's largest oil reserves have, in all likelihood, already been found, and therefore future discovery is likely to perpetually decline. This makes sense, as it stands to reason that the largest reserves, by their very nature of being the largest, would be the easiest to find. The work of geophysicist M. King Hubbert succinctly describes our current oil situation. Hubbert built a model based on past discovery of oil that predicted future production. In 1956, he correctly predicted that the peak in US oil production would likely occur sometime around 1970. Hubbert also predicted that, considering the facts mentioned above, most of the world's oil should be used up in a fairly short period of time, say 50 years or so. This phenomenon is often referred to as the “Hubbert Peak,” named after the influential geophysicist. There is a compelling consensus beginning to emerge that we may now be at or past the global peak of oil production (see Campbell 2006; Fairey 2009; Cleveland and Kaufmann 2003; and Greene et. al. 2006). This, of course, has it's own frightening implications.

Figure 3. US Crude Oil Production Since 1990 (Fairey, 2009)

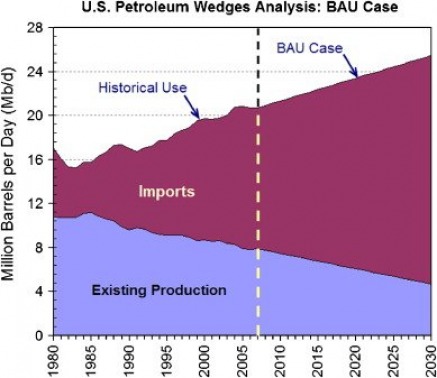

Today the US imports more than 50% of it's oil and consequently lives in a precarious economic state; some argue that the US is subject to the behavior of The Organization for the Petroleum Exporting Counties (OPEC) (Steele and Daly 1981, 43-56) while others argue that OPEC has difficulty using it's market power to its advantage (Kohl 2001, 209-233). In any case, the US economy can be easily rattled by shocks in oil prices, and even the most optimistic studies of OPECs influence concede that OPEC can significantly affect global oil supply, if even for only a short period, and that they will enjoy market power far into the foreseeable future (Greene et. al. 2006, 529). Indeed most recessions of the past half-century, including the one we're in now, were preceded by a spike in oil prices (Cleveland and Kaufmann 2003, 488).

Fig. 4. Business as usual model for US oil production and consumption through year 2030. (Fairy, 2009)

On top of that, in lieu of a viable alternative, demand for oil won't be letting up any time soon. Burgeoning economies like China and India are using ever more oil, and as other developing nations grow we can also expect them to need the resource in greater and greater amounts. All of this is certain to drive up the price of oil as supply dwindles.

But Is Drilling In ANWR a Viable Solution? - The Controversy.

But Is Drilling In ANWR a Viable Solution? - The Controversy.